If you’re as in tune with the state of AI search as the Goodie team is, you already know how we’re going to start this report: 2024 and 2025 marked seismic shifts in user behavior. What began as experimental AI features has rapidly evolved into the dominant search paradigm: As of December 2025, Google's AI Overviews now appear in 60% of search queries, ChatGPT has reached 800 million weekly active users, and the release of AI browsers by Perplexity and ChatGPT is yet again redefining what it means to “search”.

As if the landscape hasn’t changed enough already.

As we roll into 2026, it’s important that we analyze the past to continue looking to the future. Let’s dive in and:

On the surface, the data tells a clear story: traditional click-through rates have collapsed by 61% for organic results and 68% for paid ads when AI Overviews appear; yet, somehow the brands that manage to earn citations in these AI responses see 35% more organic clicks and 91% more paid clicks compared to those that don't.

The competitive landscape has become virtually unrecognizable, with user-generated content platforms like Reddit and YouTube emerging as citation powerhouses while traditional publishers struggle with massive traffic declines.

For marketers specifically, the imperative is clear: there’s no escaping AI search. It’s either hop on the bus right now or get left behind with no ticket in hand.

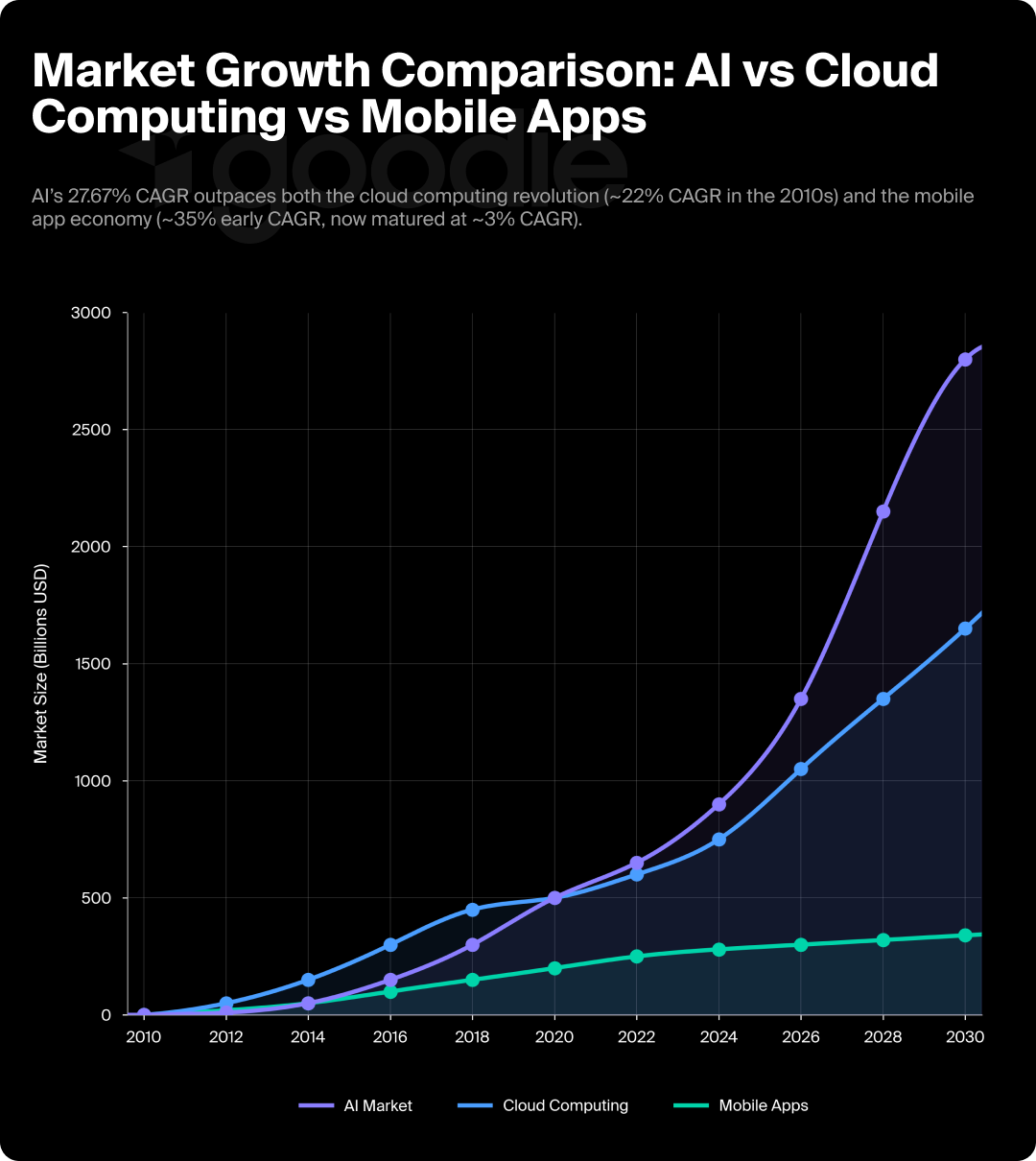

The AI market is actively undergoing explosive growth, the likes of which we’ve yet to see. As of 2024, the global AI market reached $638.23 billion, with projections showing it will surpass $1.81 trillion by 2030. Do the math, and you get a compound annual growth rate of 27.67% (that’s faster than both the cloud computing revolution of the 2010s and the mobile app economy that preceded it).

AI itself is a broad ecosystem; within it, generative AI and search-focused applications have captured the lion's share of attention and investment. U.S. private AI investment hit $109.1 billion in 2024 (that’s nearly 12 times China's $9.3 billion and 24 times the U.K.'s $4.5 billion). Generative AI alone attracted $33.9 billion globally, representing an 18.7% increase from 2023.

Double-clicking even deeper into our aforementioned ecosystem, the generative AI platform landscape has consolidated around several dominant players, each capturing specific use cases and user demographics:

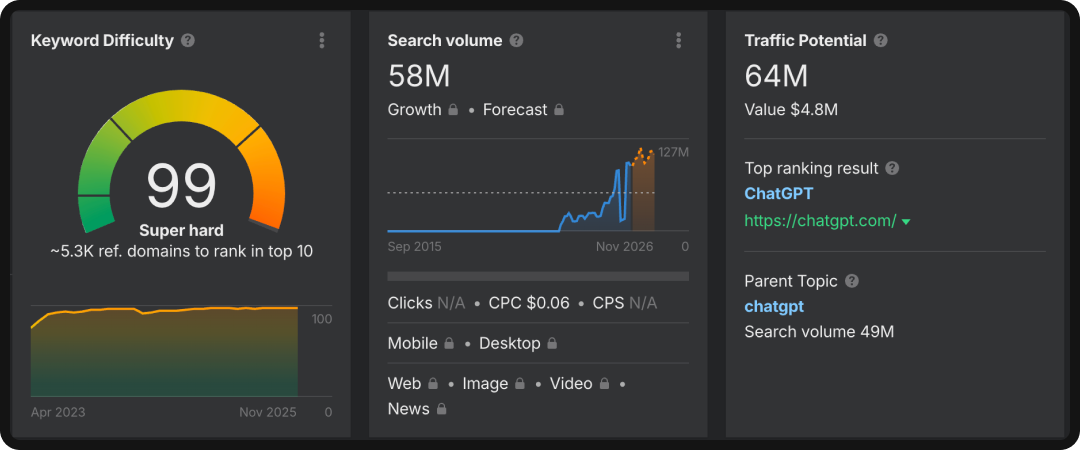

ChatGPT maintains commanding market leadership with approximately 62% of the generative chatbot market and 800 million weekly active users (as reported by OpenAI CEO Sam Altman).

The platform has achieved such mainstream penetration that the keyword "ChatGPT" is the 10th most-searched term on Google in the US, with 37.2 million monthly searches.

AI Overviews represent Google’s aggressive response to growing generative AI competition. After launching in mid-2024, AI Overviews expanded from being a part of a measly 6.49% of queries in January 2025 to appearing in over 60% of all searches by November 2025 (albeit to the chagrin of some users).

We’re used to Google changing things around on us, but this rapid rollout actually marks the fastest feature adoption in Google's history; despite the looming threat of ChatGPT and similar LLMs, Google’s commitment to search dominance is unwavering.

As of December 2025, Perplexity has carved out 6.4% of the market by positioning itself as the answer engine for users who prioritize factual accuracy and source diversity. Perplexity boasts a 99.95% query response rate (for context, that significantly outperforms Google's 58.15%).

Microsoft Copilot and Google Gemini each hold roughly 13-14% of the market, with Copilot integrated deeply into Microsoft's productivity suite and Gemini serving as Google's standalone conversational AI offering.

Anthropic’s Claude, developed by Anthropic, commands approximately 3.8% market share and has distinguished itself in enterprise contexts with structured outputs tailored for business applications.

Source: Top Generative AI Chatbots by Market Share – December 2025

To illustrate the impact of LLMs and AI search, we can turn to data on the long-time leader of search: Google's global search share has dipped below 90% for most of 2025 (for the first time in over a decade, mind you).

Looking at the market from yet another angle, adoption statistics show just how quickly AI search has transformed from novelty to necessity: the latest from McKinsey shows that 88% of organizations now use AI in at least one business function. For marketers and content creators especially, this shift is anything but theoretical; it's reshaping how their audiences discover their content every single day.

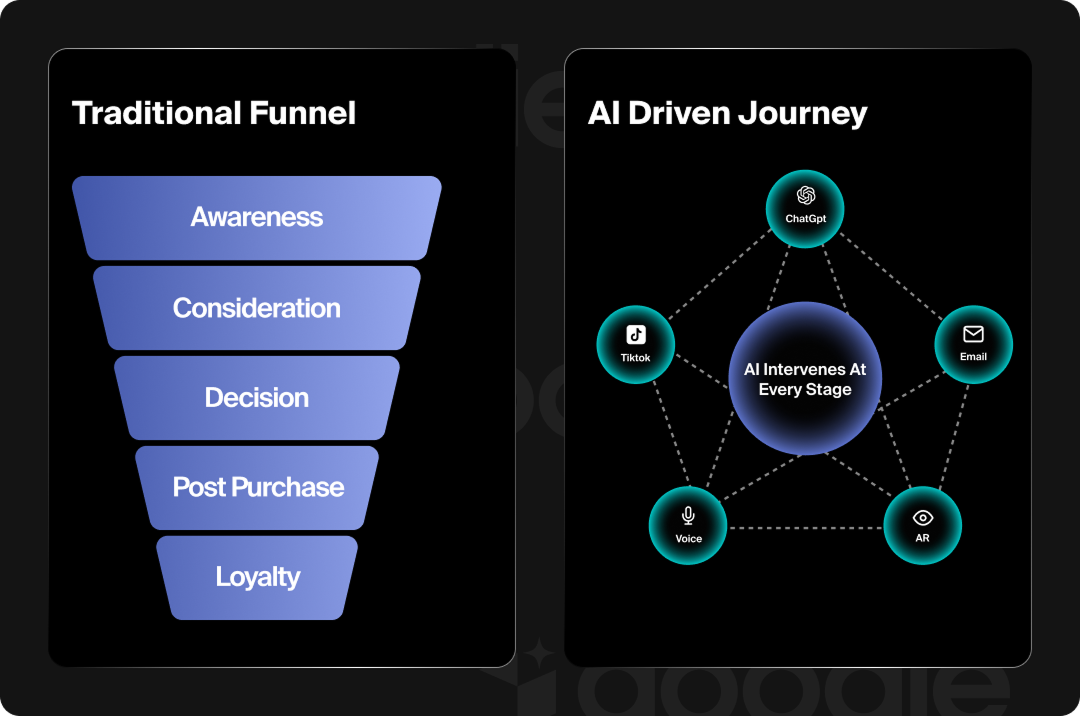

The way people search has fundamentally changed. Rather than shortening queries to remove “filler words” (or what we like to call “speaking Google’s language”) and scrolling through blue links, users now have conversations with AI systems where they are able to ask complex follow-up questions; not to mention, they also expect immediate, synthesized answers, not a list of pages to explore.

Because of LLMs’ ability to digest and answer conversational queries, long-tail, informational searches have risen to power in the AI era:

This reflects users' growing comfort with asking AI systems full questions like "What's the best beginner-friendly espresso machine under $300?" rather than converting their query to “Google-speak” and instead searching for "espresso machine reviews."

At the same time as AI search activity is on the rise, the user journey has been cut off at a major artery: zero-click searches (where users get their answer without clicking through to any website) have surged. This represents a fundamental challenge to traffic-based business models that have sustained digital publishing for decades. Now, when an AI Overview takes the job of providing a direct answer (above the fold, right in front of the user’s face), only 8% of visits result in a click when an AI Overview appears.

If you’re reading this and wondering what happened to the “don’t trust AI” epidemic, we have news for you: the numbers say it’s over. Consumer trust in AI recommendations has reached surprising levels. Attest reports that 43% of consumers would trust product recommendations from an AI chatbot or tool.

Switching gears to multimodal search, voice search also continues to accelerate adoption, with 20.5% of people worldwide actively using it. To add gas to the flame, voice search particularly favors AI responses (especially given that users expect single, definitive answers rather than lists of options when speaking to devices).

B2B search behavior shows particularly dramatic shifts; though, when comparing the demographics performing searches of this nature, this may come as no surprise. The presence of AI Overviews for B2B tech queries increased from 36% to 70%. This sector, traditionally dominated by longer sales cycles and research-intensive decisions, has proven especially amenable to data produced by AI, especially information that helps to compare options and explain complex products.

When we talk about visibility, we’re shifting perspectives from SERP rankings to citations and brand mentions. What do we mean exactly? When LLMs generate responses, they draw from a relatively small pool of highly trusted sources, creating clear winners and losers.

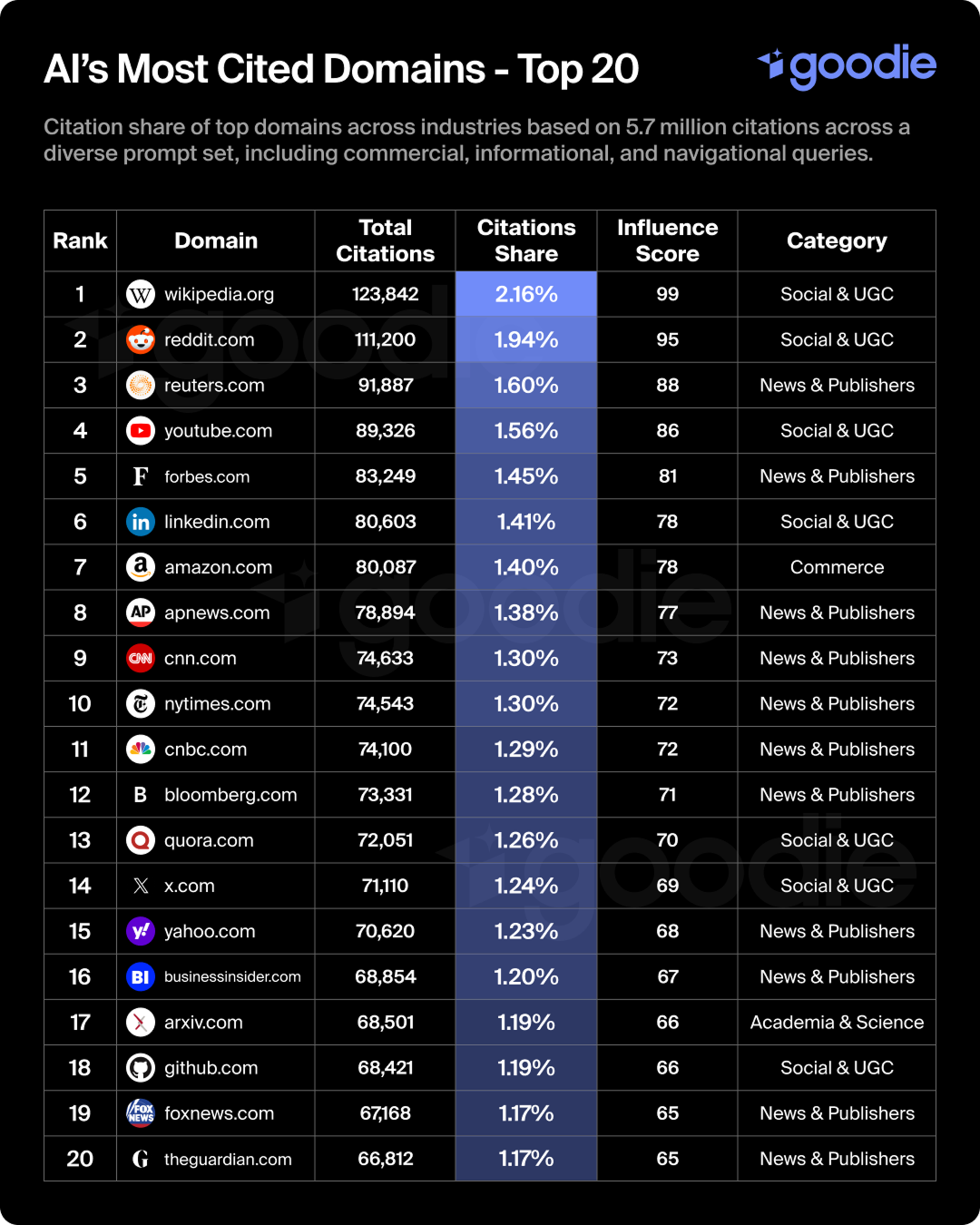

Universal citation leaders have emerged across nearly every platform and topic. According to our own research, AI’s 20 most-cited domains can be grouped into four distinct categories:

In our opinion, the presence of so many user-generated content platforms represents one of the most surprising developments in AI search. These platforms weren't traditionally considered authoritative in the SEO sense; they don't have the editorial oversight of major publications or the credentials of academic institutions.

Yet, AI systems consistently favor social and user-generated content for a simple reason: this type of content is more likely to contain authentic, experience-based answers to the exact questions users ask, written in natural, conversational language.

In the healthcare space, citations lean heavily toward institutional sources, with NIH capturing 39% of health-related citations, followed by Healthline at 15%, Mayo Clinic at 14.8%, and Cleveland Clinic at 13.8%.

The high stakes of medical information drive AI systems toward sources with clear expertise, authoritativeness, and trustworthiness (E-E-A-T) signals. Studies show that 45% of medical keywords trigger AI Overviews, making this one of the most AI-impacted sectors.

The finance sector shows distinct patterns in Goodie's analysis of consumer banking and financial product queries. NerdWallet emerges as the singular leader across all four major AI models, while the top 10 domains account for 27.8% of all consumer finance citations.

The finance landscape demonstrates that brands themselves rarely get cited directly; instead, affiliate sites, review platforms, and financial publishers where brands are featured dominate the citation space. Reddit plays a crucial role in awareness, research, and early-stage validation, particularly during periods of financial volatility when users seek live insights verified by peers.

Research in the beauty and personal care space reveals dramatic concentration, with Goodie's research showing that just 10 domains capture 36.7% of all beauty AI citations. Reddit once again dominates, appearing across all four major LLMs and claiming the #1 overall position, with citations pulling from both posts and threads.

Sephora, Byrdie, and Allure combine user discussion, editorial authority, and direct commerce to shape the beauty discovery journey. The beauty industry demonstrates how user-generated content, consumer review sites, and social platforms hold outsized influence as users gravitate toward authentic content with peer testimonials.

Brands in the B2B SaaS space encounter a uniquely challenging citation landscape. Goodie's analysis of 118,067 B2B SaaS citations reveals that 35% come from just 10 domains, yet (similar to Finance), actual SaaS brand websites are completely non-existent in the top 10.

Instead, AI models cite a mix of social platforms and UGC (Reddit, Wikipedia), affiliates and listicles (G2, Capterra, TrustRadius), and news and publishers. Not to sound like a broken record, but Reddit also has a chokehold on the B2B SaaS citation space (ranking first in two models, second in one, and sixth in our outlier, Gemini).

Gaming represents the most extreme case of user-generated content dominance, with YouTube capturing 93% of gaming-related citations and Reddit at 78%. Fandom wikis account for 26.7% and Steam Community for 11%.

Interestingly enough, official publisher websites rarely appear; the most useful gaming information comes from the community itself through walkthroughs, strategy guides, and discussion threads.

Sports queries pull heavily from YouTube at 37.5% and Wikipedia at 32.4%, combining video highlights with quick statistical references that answer common questions about players, teams, and events.

Citation volume has increased dramatically as AI systems have evolved. AI Overviews now cite an average of 13.34 sources per response, with some responses reaching as many as 95 links. This represents nearly a twofold increase from 2024, when the average was approximately 6.82 links. Longer, more comprehensive AI responses cite proportionally more sources: AI Overviews under 600 characters cite about 5 sources, while those over 6,600 characters cite around 28 sources.

The citation advantage translates directly to traffic, but with important nuances. When brands are mentioned in AI Overviews, they receive 35% more organic clicks and 91% more paid clicks compared to queries where they aren't cited. This tells us that citations serve as powerful trust signals that drive subsequent engagement.

So, how do we know which factors carry more weight?

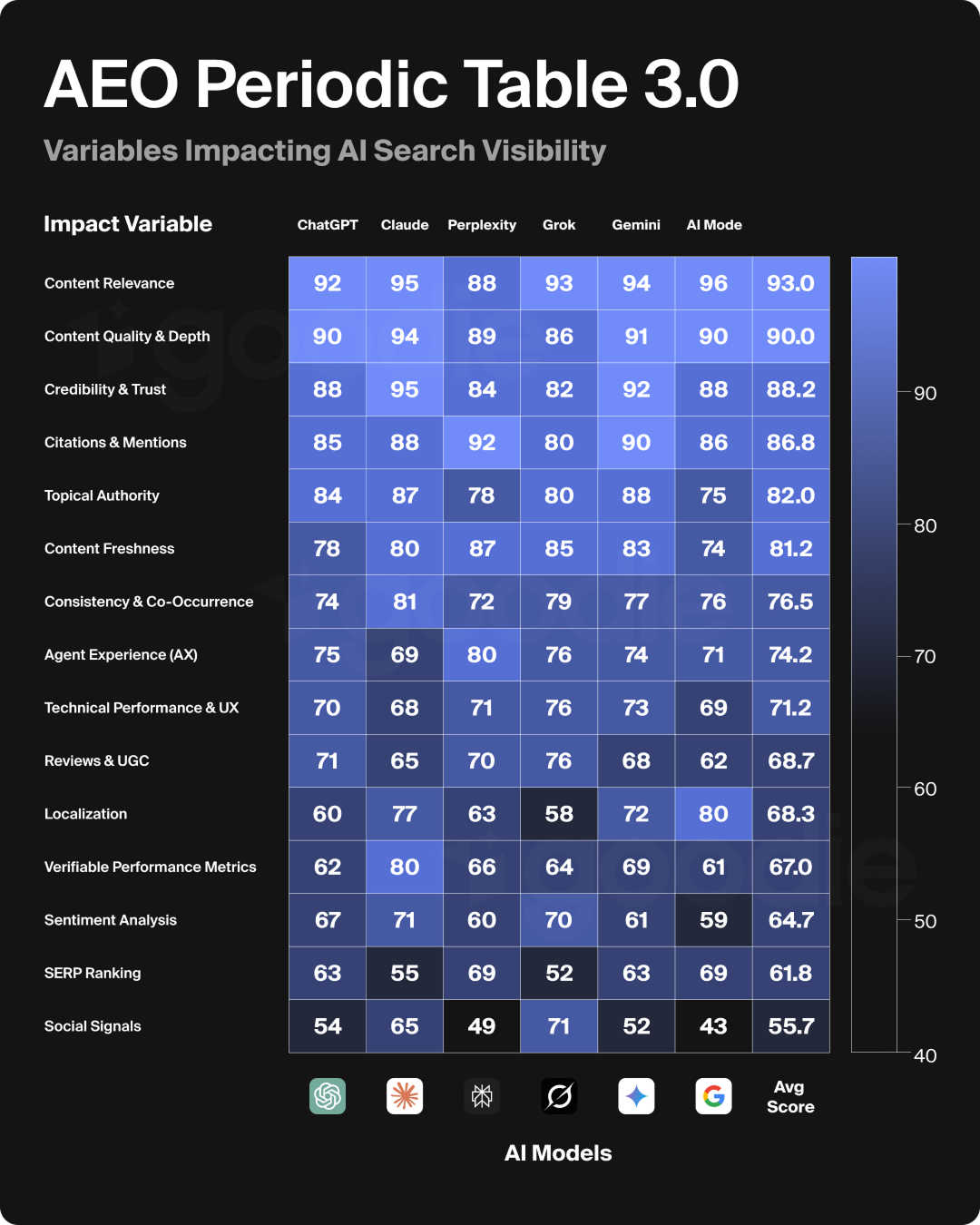

Research from Goodie’s comprehensive analysis of over 1 million prompts across ChatGPT, Gemini, Claude, Grok, and Perplexity revealed 15 distinct factors that influence AI citations, organized into four impact tiers. The highest-impact factors scoring between 85-100 points include content relevance, content quality and depth, credibility and trust, and citations and mentions (though different models weigh these factors differently). Claude, Gemini, and AI Mode set the highest bar for relevance, while Perplexity and Gemini assign greater weight to citations and mentions.

The arrival of AI Overviews and competing answer engines has triggered the most dramatic traffic redistribution in internet history, creating new and increasingly complex challenges for how marketers measure and attribute their success.

Click-through rates have collapsed across the board. Seer Interactive's comprehensive study analyzing 3,119 queries across 42 organizations found that organic CTR plummeted 61% (from 1.76% to 0.61%) for queries with AI Overviews, while paid CTR crashed 68% (from 19.7% to 6.34%).

Traffic redistribution has created stark winners and losers. Reddit stands out as the clear beneficiary, with overall traffic growing to 1.4 billion monthly visits by April 2025, supported by its explosive 450% increase in AI citations from March to June 2025. The platform's authentic, user-generated discussions provide exactly the type of experiential content that AI systems favor.

Though they are commonly cited by LLMs, news and publishers are feeling the hit of this new search landscape just the same; publishing sites have suffered catastrophic losses.

The citation paradox presents a troubling reality: being cited in AI responses doesn't guarantee proportional traffic. Wikipedia is a great example of this phenomenon: it remains one of the most-cited sources across all AI platforms yet continues to struggle with monetization precisely because users consume its information through AI intermediaries rather than visiting it directly.

Referral traffic from large language models represents a growing but still modest traffic source for most publishers. ChatGPT's referral traffic has grown dramatically, with referrals expanding from fewer than 10,000 domains per day in July 2024 to more than 30,000 by November. For small and medium-sized businesses specifically, generative AI referral traffic was up 123% in the first half of 2025, suggesting that successfully appearing in AI responses can drive meaningful traffic (just through different channels than traditional search).

As if the changes in traffic monitoring weren’t enough to keep track of, attribution has also become exponentially more complex. Traditional conversion tracking assumes a relatively direct path from search query to website visit to conversion. AI search introduces multiple touchpoints where users may encounter brand information without generating a trackable click; think reading about products in ChatGPT responses, hearing brand mentions from voice assistants, or seeing companies cited in AI Overviews without clicking through.

Most of the solutions readily available to marketers are half-baked:

All of this is to say, the metrics that matter have fundamentally shifted. Rather than focusing exclusively on clicks and traffic, savvy marketers (like us at Goodie!) now track:

The Goodie platform addresses these attribution challenges by integrating with GA4 and providing dedicated tracking for AI-generated traffic sources, allowing marketers to quantify the downstream impact of AI citations on website traffic, leads, and conversions.

As AI search has matured from an experimental feature to a dominant paradigm, a new discipline has emerged to help brands maintain visibility: Answer Engine Optimization (AEO). Unlike traditional SEO, which optimizes for appearing in search engine results pages, AEO focuses on becoming the answer that AI systems cite when responding to user queries.

The fundamental challenge of AEO stems from the binary nature of AI responses: you’re either visible or you’re not. Where traditional search presents ten blue links, and users can click around and discover your content (as long as you rank on Page One), AI typically provides a single synthesized answer pulling from a handful of sources.

Going back to our AEO Periodic Table can help us understand which factors exactly make or break a brand’s AI visibility (or lack thereof). We analyzed over 1 million prompts across five major AI platforms (ChatGPT, Gemini, Claude, Grok, and Perplexity) to identify 15 core factors that determine AI citations. This provides the most data-driven framework available for understanding AI search visibility.

Goodie’s latest analysis of 2.2 million prompts across six major AI platforms (ChatGPT, Claude, Perplexity, Grok, Gemini, and Google AI Mode) from January through June 2025 identified the 15 core factors that determine AI citations. This research also revealed significant shifts from traditional SEO approaches, with classic SEO metrics fading while semantic depth, structured clarity, and real-time freshness emerged as the new power trio.

Another significant discovery made was the rise of co-occurrence as a critical new factor. LLMs now cross-reference multiple sources before citing content, making a consistent presence across authoritative domains essential for visibility.

Here’s a breakdown of the key factors shaping AI search visibility:

The foundation laid in 2024-2025 will determine the trajectory of AI search for years to come. Several clear trends will define 2026 and beyond.

The shift from ranking to being "the answer" represents the most fundamental change in information discovery since Google itself emerged 27 years ago (woof, has it been that long?). Brands that recognize this transformation and adapt their strategies accordingly will thrive in the AI search era.

Those that cling to traditional SEO playbooks while ignoring AEO imperatives risk becoming invisible in the channels where their audiences increasingly spend time.

AI Overviews have fundamentally restructured the search landscape, appearing in over 50% of Google queries and dramatically affecting user engagement. Organic click-through rates drop 61% and paid CTRs collapse 68% when AI Overviews appear, creating significant traffic challenges.

In short, and as discussed in this article, AI Overview optimization is no longer optional; it's essential for maintaining visibility in an increasingly zero-click search environment.

As of late 2025, approximately 50% of all Google searches in the United States include an AI Overview, representing explosive growth from just 6.49% in January 2025 to 13.14% by March before surging past the 50% threshold by October.

The rollout varies by device and region, with about two-thirds of all Google searches occurring on mobile devices where AI Overviews dominate. Industry-specific variations reveal Google's strategic approach: informational sectors like health, education, and science see the highest coverage, while transactional eCommerce queries remain largely protected.

Here are the facts:

ChatGPT and Google AI Overviews represent fundamentally different approaches to AI-powered search.

Citation approaches also vary:

Optimizing across the diverse AI search landscape requires understanding platform-specific priorities while implementing universal best practices. Goodie's analysis reveals that:

Universal principles that work across all platforms include creating comprehensive, high-quality content, establishing clear expertise through credentials and institutional affiliations, implementing structured data and schema markup, and developing original research that becomes citation-worthy.

Content format diversification addresses platform strengths:

Traditional search metrics like rankings and clicks no longer capture AI search's full impact, requiring expanded measurement frameworks.

Ready to take control of your brand's AI search presence? Learn more about how Goodie helps enterprises monitor visibility, optimize content, and drive growth across ChatGPT, Perplexity, Google AI Overviews, and every major AI platform.

Some icons and visual assets used in this post, as well as in previously published and future blog posts, are licensed under the MIT License, Apache License 2.0, and Creative Commons Attribution 4.0.

https://opensource.org/license/MIT